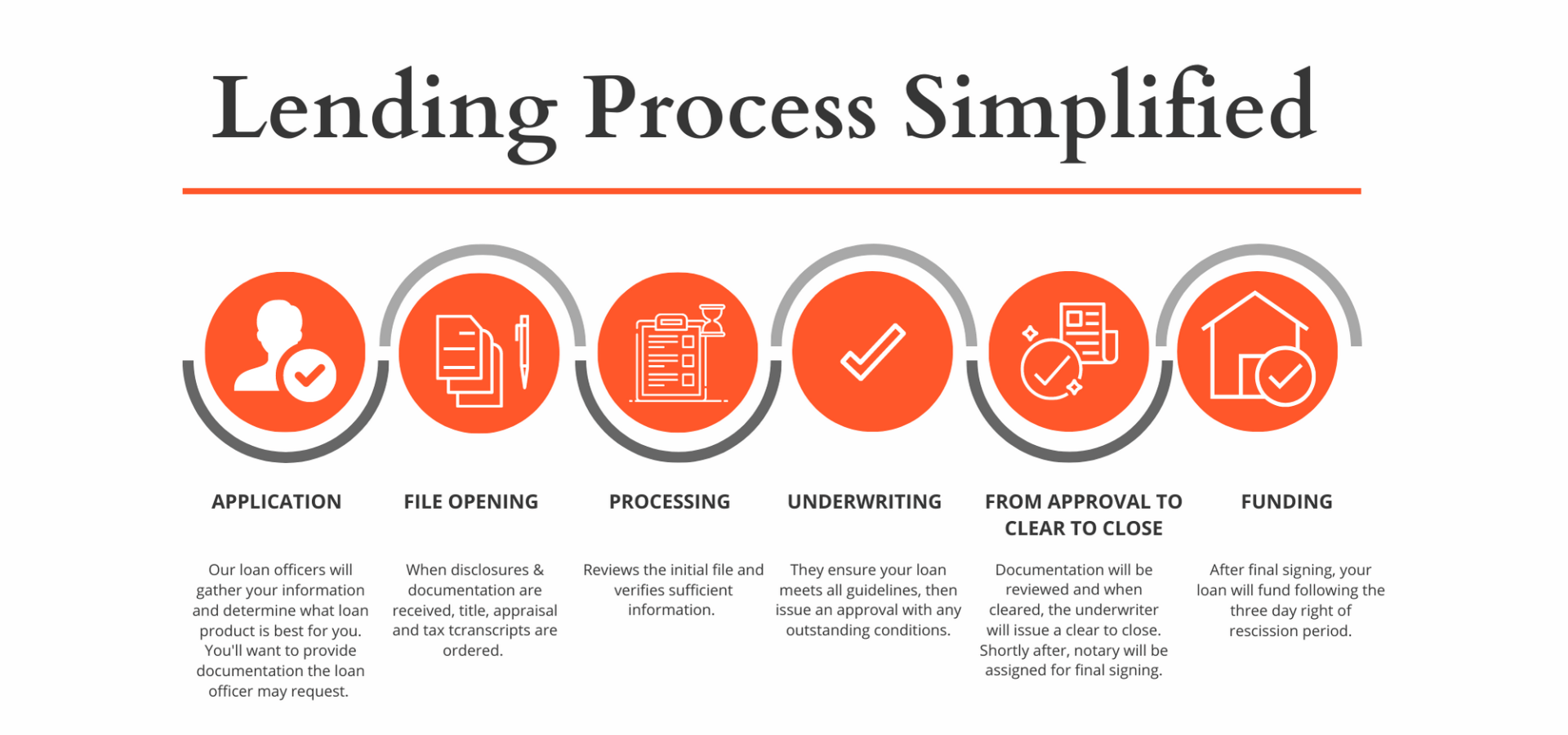

The Lending Process

Application: Complete Application with Mortgage Banker and provide a copy of your mortgage statement. Have your Income information handy to reference.

- Once the offer has been accepted, sign E-Disclosures and provide the required documents

- The loan will be locked and set to opening to order the appraisal, title, etc.

Processing: Your opening processor will make an introduction and will let you know if any updated documents or signatures are needed, he/she will also verify your employment with your employer.

- They will package the loan up for the underwriter and will work hand in hand with the underwriter to obtain the final approval. Any necessary information will be requests by the processor at this time.

- Final e-disclosure signatures are issued – these are time sensitive to your closing so please make sure to work with the processor on making sure this is completed as soon as you receive them.

Underwriting: Underwriter issues the clear to close – this signifies that you are clear to go to the signing table.

- Documents are drawn and a notary is assigned to your loan closing – sometimes this process can be quick to ensure your loan closes by the lock expiration date. Please make sure to schedule the notary accordingly and please ask your processor or mortgage banker if you have any questions.

Closing: Documents are signed by you and the notary. Once completed the notary will fedex the signed documents to us and the closing escrow company.

- This will take a few days to ensure the documents are reviewed, fully scanned, meet quality control requirements and accounted for. Please reach your closing processor or mortgage banker with questions.

Funding: Your loan will fund, the wire will be sent to your servicer. Sometimes this takes a day or two to reflect in their system. Any questions please refer to your closing processor or mortgage banker.

- If you chose to receive cash back as part of your refinance, this could take up to a week to be issued out from closing. The escrow company is responsible for holding this money and disbursing it. This will be disbursed how you requested the funds to be issued IE fedex express mail or regular mail. If we are paying off credit cards, the checks will be issued to the creditors but will be mailed for you to disburse accordingly. Please reach your closing processor or mortgage banker with questions.

- You will make your first payment 30-60 days after you sign your loan documents. Generally the rule is, the month you sign and the month after you defer the payment.

For example:

- You sign January 12th, your first payment will be due March 1st.

- You sign January 31st, your first payment will be due March 1st.

Some important TO DO’s or DO NOT DO:

TO DO’s:

- Send copies of updated bank statements/paystubs/mortgage statements/updated insurance declarations pages as they come to your mortgage banker/mortgage processor

- Make all your payments on time

- Follow up with your mortgage banker if you have any questions

- Be diligent with checking e-mails regarding your loan

DO NOT’s:

- Do not run your credit this could affect your credit score which could affect your approvability

- Do not co-sign on any new loan, credit card during the process

- Do not open any new loans, credit cards during the process

- Do not buy a new property, boat, car during the process